Is it a Good Time to Invest in Property in NSW? (Mid-year 2025 Market Update)

Is it a Good Time to Invest in Property in NSW? (Mid-year 2025 Market Update)

The NSW property market is regaining momentum in 2025, driven by improving buyer confidence, two interest rate cuts and persistently tight supply.

Property prices are rising in both metropolitan and regional areas, with some segments outperforming expectations despite lingering affordability pressures.

In addition, the latest economic indicators, price movements and investor trends point to improving conditions for those considering NSW property.

Prices continue to rise across the state

NSW property values have climbed steadily through the first half of 2025.

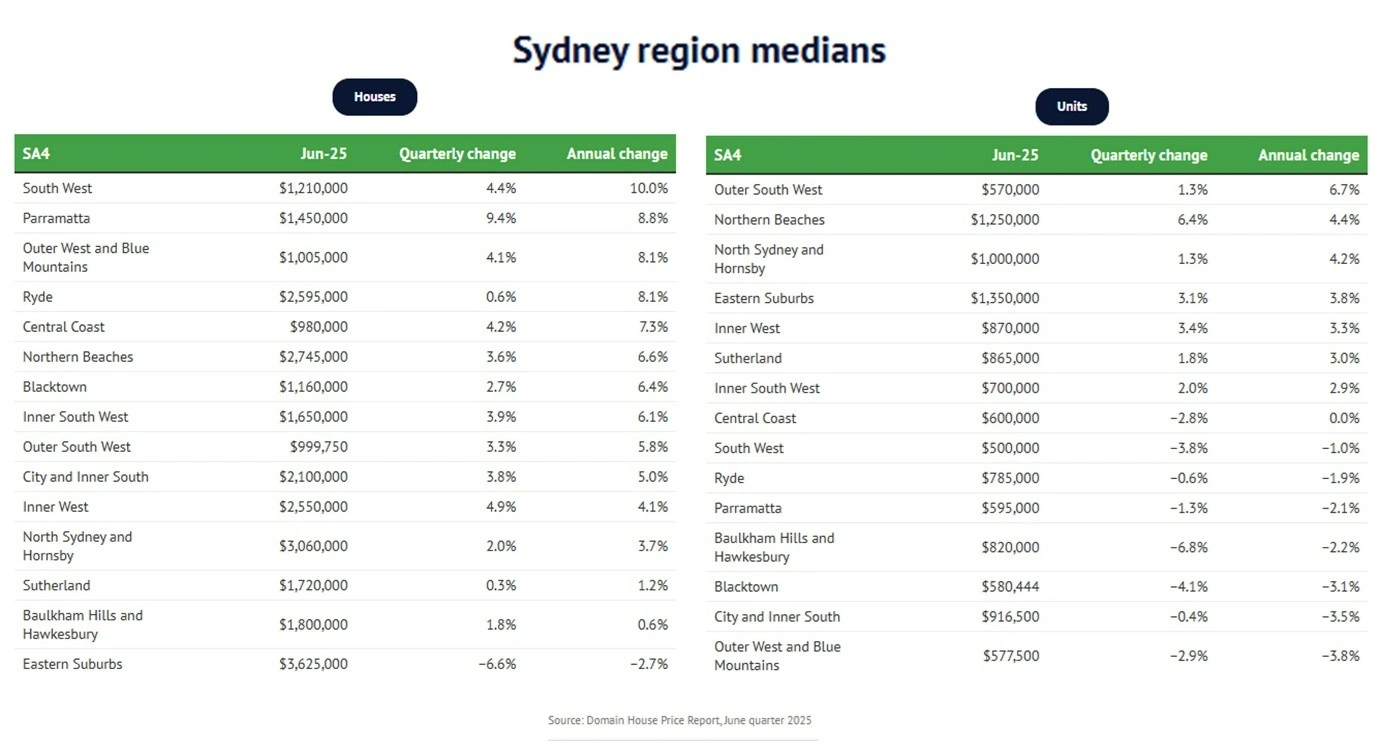

According to Domain, Sydney’s median house price rose 4.2% annually in the 12 months to June, reaching a new record high of $1.72 million. Unit prices also increased 3.2% year-on-year to $835,000.

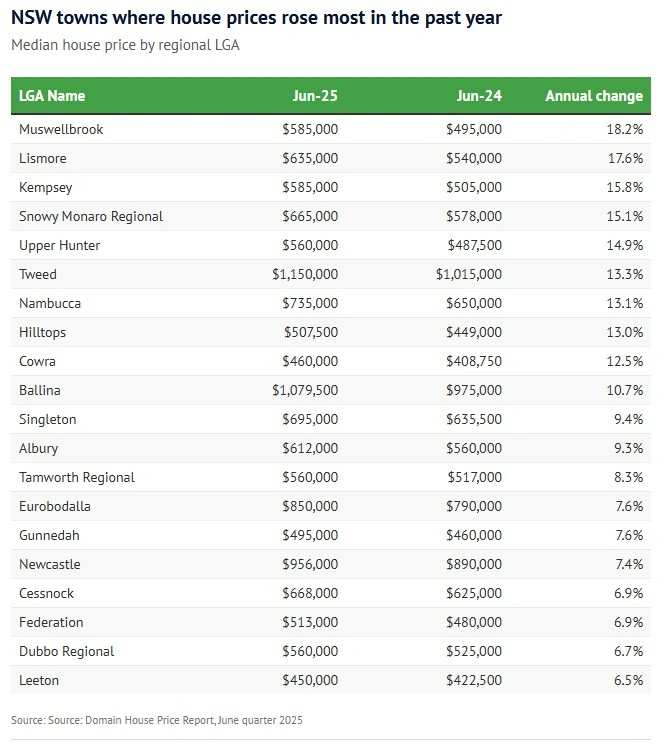

But it’s not just the capital seeing growth. Over the same period, regional NSW outpaced Sydney with a 5.3% annual rise in house prices, pushing the median to $800,000. This is the strongest regional growth in three years.

The price uplift is consistent across many buyer groups, including owner-occupiers and property investors. Lower stock levels and increased competition are intensifying buyer activity, despite broader concerns about the cost of living. These supply constraints are a key component of the current NSW property market update 2025.

Rate cuts are reigniting borrowing capacity

The Reserve Bank of Australia (RBA) cut the official cash rate twice in early 2025, firstly to 4.10% in February and again to 3.85% in May. These moves have improved borrowing capacity, particularly for those looking to invest in real estate NSW in 2025. Furthermore, the July RBA meeting minutes reveal that another two cash rate reductions are expected this year, especially as inflation data is tracking towards target. That said, should upcoming figures confirm a stabilised inflation outlook, REA economist Angus Moore believes another cut may arrive as early as August.

“Unless there is a big surprise in the inflation data, we’re likely to see that cut.”

Demand remains high, especially at the lower end

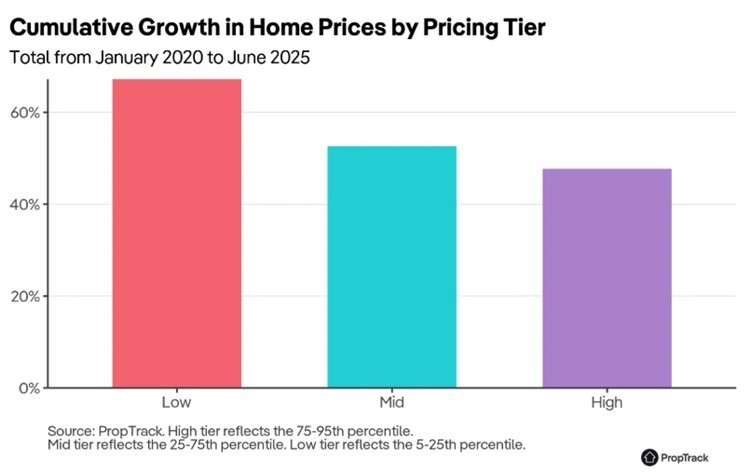

Notably, homes at the more affordable end of the market have seen the greatest price growth over time. Proptrack data shows that property prices in low-end markets increased by 67% between January 2020 and June 2025, outperforming the 52% growth in mid-range areas and 47% in higher-priced markets.

With this trend expected to continue in the coming months, buyer behaviour is changing, especially for those prioritising capital gains potential and asking: is it a good time to invest in property NSW?

According to the latest PIPA Adviser, investor activity is strengthening in both regional and metropolitan markets. While in Sydney, premium stock and infrastructure-adjacent areas are performing well, strong rental yields and employment hubs in regional centres continue to attract interest.

Tight supply is supporting property prices

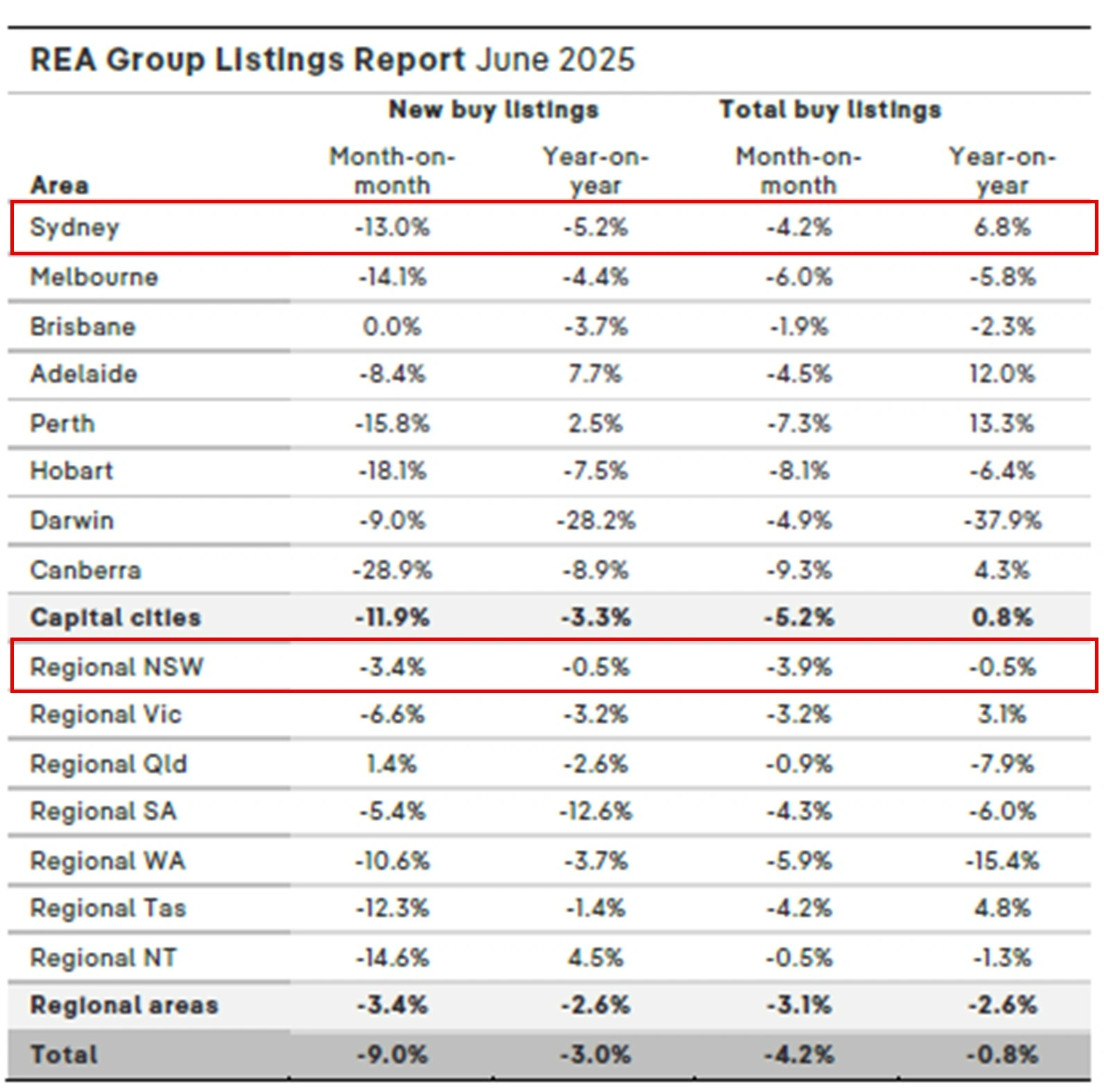

The REA Group Listings Report indicates that new listings in Sydney decreased by 13% month-over-month in June. Although this reflects a national seasonal slowdown into winter, the volume also experienced a 5.2% annual decline.

Demand for housing hasn’t spiked materially. But ANZ economist Madeline Dunk told Domain that a lack of supply was continuing to put upward pressure on prices. In fact, if lower interest rates this year accelerate buyer activity throughout the spring and summer selling seasons, increased borrowing capacity is likely to result in even faster price growth.

For those tracking NSW property investment trends in 2025, lower stock levels may influence when to enter the market.

Investor outlook: conditions may improve further

The outlook for property investors is cautiously optimistic. With tight rental markets, low vacancy rates, and consistent gross yields, entering the market ahead of further rate cuts could deliver both capital gains and income growth.

At the same time, macroeconomic risks, such as labour market softening or geopolitical volatility, still need monitoring. RBA governor Michele Bullock noted recently that while interest rates are a blunt tool, the board is focused on balancing inflation and employment, and will only act when the data justifies it.

These factors are prompting some investors looking to invest in real estate NSW in 2025 to move early, as fundamentals remain strong and conditions may become more competitive later in the year.

Is it a good time to invest in NSW property?

There is no perfect time to invest. But for buyers with a long-term strategy, strong financial footing, and professional advice, mid-2025 offers multiple reasons to act:

- Property prices are climbing steadily, especially in affordable segments

- Borrowing capacity is rising as interest rates fall

- Listings are low, supporting further capital growth

- Investor sentiment is improving, supported by yields and demand

For investors, the answer to the question of ‘is it a good time to invest in property NSW’ may be yes, particularly if acting ahead of further rate cuts. For NSW property investors looking to enter the market before those rate cuts arrive, this may be a strategic moment to take action.

If you’re considering a long-term investment in the NSW property market, BFP Property Group can help you make confident, well-informed decisions. Whether you’re starting out or looking to expand your portfolio, get in touch today for expert guidance tailored to your goals and financial position.